IMPORTANT: Investing involves risks, including the potential loss of your entire investment. Market fluctuations, currency exchange rates, and other factors may affect your returns. Past performance is not a guarantee of future results.

U.S. bonds can be a great way to tap into fixed income investing.

When it comes to investing in the U.S. bond market, there are a number of ways to get started and a wide variety of institutions that issue fixed income securities, including the U.S. government, state and local governments, and publicly held companies.

Discover the right U.S. bonds for your financial goals with Schwab.

Explore a wide selection of bonds from a variety of issuers, all backed by Schwab's transparent pricing and expert tools.

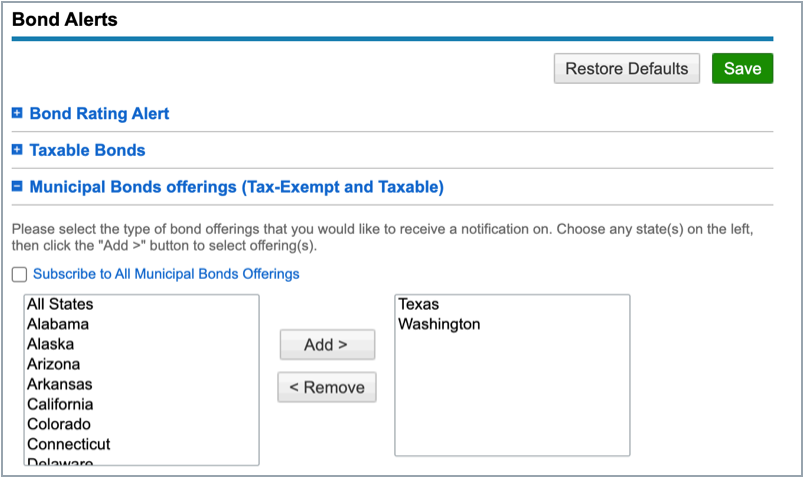

Whether you're seeking municipal bonds, treasury bonds, or corporate bonds, Schwab BondSource® gives you access to thousands of choices—at the best price available to Schwab. With over 80,000 bonds to choose from, and powerful resources like independent research and daily market updates, Schwab makes it easy to find the perfect fit for your portfolio.

-

Individual securities

80,000+

-

Bond dealers

200+

This data represents average daily quote count between January 1–June 23, 2020, and represents distinct cusips and total quote depth available to Schwab received by venues connected to Schwab BondSource. Obtained through Schwab's centralized data storage system, data is received on a T+1 basis. Duplication may exist within quote depth figures due to quotes being received from multiple venues. Counts may not be representative of quotes available to clients, as the data has not been filtered to exclude restricted cusip quote blocks. While CS & Co. Fixed Income has used reasonable efforts to ensure the accuracy of this data, it has not been vetted by an independent third party.

Our powerful tools can help you research and trade U.S. bonds.

Get a balanced perspective on the U.S. bond market with timely insights and third-party research.

In addition to daily market updates and ongoing global commentary, Schwab offers premium independent research from Briefing.com, Credit Suisse, and others.

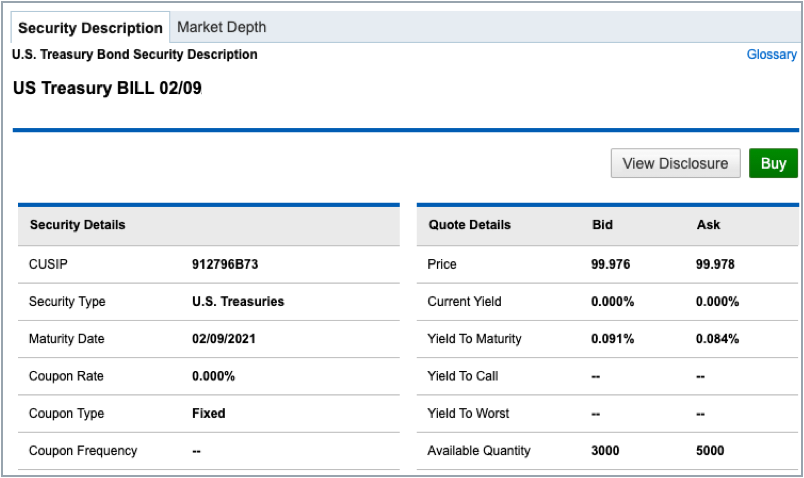

Get straightforward pricing that is disclosed before you buy a bond.

At Schwab, there's no mystery about our pricing. It's straightforward, simple to understand, and provides a great value.

U.S. Bonds FAQs

The safety of U.S. bonds depends on the issuer. Treasury bonds are among the safest since payment of principal and interest is backed by the U.S. government. Municipal bonds, issued by states and local governments, are generally safe as they are typically backed by taxes or user fees from services that are often essential, but it depends on the issuer's creditworthiness. Corporate bonds can offer higher yields than those offered by other fixed income securities with similar maturities, but with greater risk of loss.

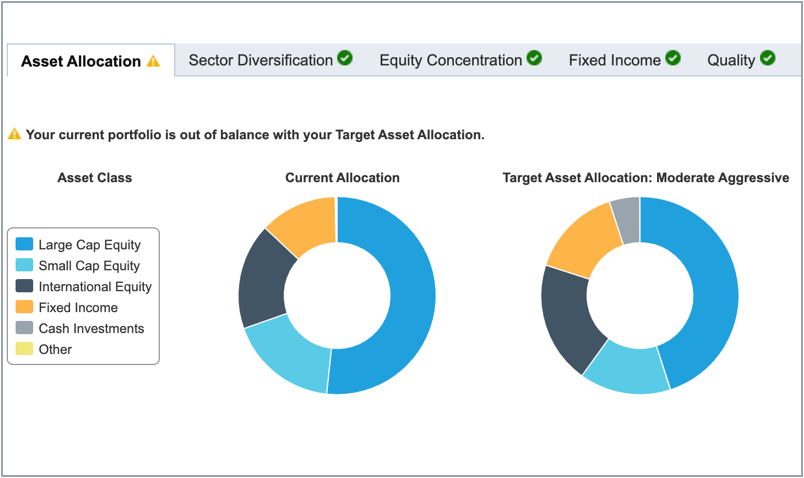

U.S. bonds can provide a measure of stability and the potential for steady income through interest payments. Bonds can also help diversify an investment portfolio, potentially reducing overall risk.

The minimum investment for U.S. Treasury bonds is 1 bond or $1000 face value. Municipal and corporate bonds typically require a minimum of around $1,000, though this varies by issuer.

Start investing in the U.S. markets today.

-

Start investing in the U.S. markets today.

Have more questions? We're here to help.

-

Call

CallNew clients

+44 203 795 2704

Existing clients

0808 234 6306 (freephone from the UK)

1-800-362-1774 (in the US)Customer service hours

Monday to Friday 24 hours -

Email

Email -

Visit us

Visit usCharles Schwab, UK., Limited

33 Ludgate Hill

London EC4M 7JN

United KingdomOffice hours

Monday-Friday, 9:00 am to 6:00 pm (UK Time)