What Are 0DTE Options? Learn the Basics

Zero-days-to-expiration (0DTE) options strategies have gained significant popularity. Roughly 1.5 million 0DTE options trade daily, accounting for nearly half of all options trades tied to the S&P 500® index (SPX), according to 2025 data from Cboe Global Markets. Much of this explosive growth has occurred just three years after daily expiration trading became widespread on the SPX and other major indexes. Despite its popularity, 0DTE options trading has drawn scrutiny from some who believe it's causing increased volatility.

What are zero-days-to-expiration (0DTE) options?

A 0DTE option is an options contract that expires at the end of the current trading day. By definition, all options contracts, whether issued six months ago or last week, become 0DTE on their expiration date. But regardless of their purchase date, options can experience significant price swings just before they expire.

Leading the way in this growth has been Cboe®, the world's largest options exchange. In 2005, it introduced weekly SPX options that expired on Fridays. By 2016, the exchange added SPX weeklies that expired on Wednesdays. In 2022, Cboe expanded to offer weekly options expiring on every trading day. Now, qualified option traders can trade 0DTE SPX options (and options on a few major ETFs) every market day.

Options trading involves unique risks and is not suitable for all investors. Like all of our strategy discussions, this article is strictly for educational purposes only. It is not, and should not be considered individualized advice or a recommendation.

What's behind the growth of 0DTE options?

Retail customers have been crucial to the rising demand for 0DTE options, according to the Financial Industry Regulatory Authority (FINRA). But what's the allure of an option with the lifespan of the average mayfly? Here are some considerations:

- Limited overnight risk: 0DTEs expire just after the market close (4:15 p.m. ET), eliminating the risk of holding positions overnight.

- Cost-effective: The erosion of time value makes 0DTE options potentially less expensive compared to options with more days to expiration, meaning premiums can be in cents rather than dollars.

- Tight spreads: Liquidity is typically high in the 0DTE market. As a result, the gap between bid and ask prices is usually narrow, which can help reduce trading costs.

How do 0DTE options work?

The principles of trading 0DTE options are effectively the same as trading longer-term options. The price of an option is largely influenced by the price of the underlying security, but factors like implied volatility and time until expiration—a mere blip for 0DTE contracts—play a role. Here are two hypothetical scenarios.

Example 1: News play

Watching pre-market action, a trader anticipates a quick upward price swing due to impending news. They purchase 10 slightly out-of-the-money (OTM) call options for $0.40 each, a $400 investment before transaction fees. With only a few hours until expiration, the trade has limited time for a potential profit to materialize. As with all long calls, the trader's profits are theoretically unlimited if the underlying security rallies in time. If the underlying security remains flat or declines, the option will probably expire worthless, and the maximum loss is equal to the premium paid.

Example 2: Short-term hedging

Concerned about an existing long position ahead of a product release or Fed announcement, a trader buys OTM long puts as a hedge. If the stock falls intraday, any gains in the puts (minus premium paid) will help offset the stock loss.

Option traders, however, aren't limited to just straight bullish or bearish call and put purchases. More advanced traders might use neutral trading strategies—such as iron condors—to speculate on range-bound price action. Spread traders may also use 0DTE options because of their defined risk and rapid time decay, which can work in favor of option sellers.

How to manage risk with 0DTE options

Because they are short-lived instruments, 0DTE options are subject to significant volatility and require close monitoring. Profits can vanish quickly, and minor intraday movements in the underlying asset can significantly impact the options contract's value.

With a trading life of only one day, 0DTE options may lose most of their value within a trading session due to time decay—a concept known as theta. Gamma, which measures changes in an option's delta, makes 0DTE options highly sensitive to even minor price changes in the underlying security.

In a common 0DTE strategy, traders may speculate on a range-bound or lower trading session. If the market declines, those who sold calls can pocket the premium received. However, if the calls are uncovered, and if the underlying security's value rises above the call's strike price, losses can be theoretically unlimited.

To mitigate this risk, experienced traders often consider stop orders to potentially avoid assignment, though such a result is not guaranteed. A stop order is intended to limit losses by selling a long position or buying a short position at a predetermined level if the market moves unfavorably.

How does volatility affect 0DTE options?

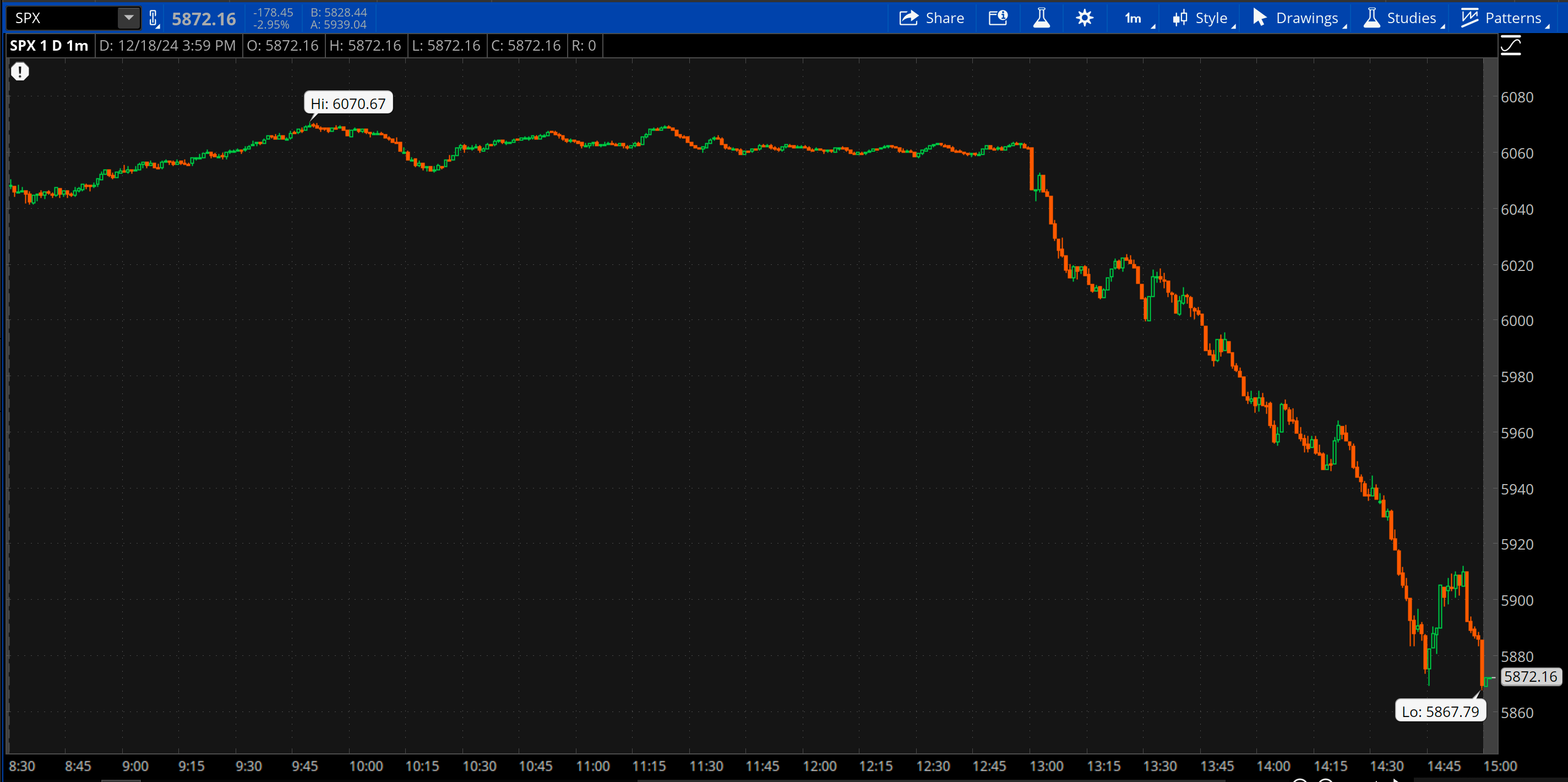

With such a limited time frame, unexpected volatility can also teach lessons about significant risk. For example, on December 18, 2024, the SPX plunged after Fed Chair Jerome Powell said future rate cuts would likely be fewer than previously stated. The index quickly lost almost 3%, marking its worst Federal Open Market Committee (FOMC) announcement day since March 2020.

Because the Fed's announcement came, as expected, around 2 p.m. ET, traders only had two hours before the close to exit or adjust positions. Theoretically, if 0DTE traders sold iron condors in anticipation of range-bound trading, they would have likely suffered the maximum loss as stocks plummeted through short strikes. Call buyers would have seen positions go from profitable to losing within two hours. And put sellers were also likely to face significant losses.

While this Fed-driven price shift was unusual, this is a textbook example of why 0DTE options can be risky, especially around scheduled events.

來源:thinkorswim® 平台

Past performance is no guarantee of future performance. For illustrative purposes only.

A note about account management

The pattern day trader rule is designed to protect investors from risks associated with frequent day trading. As of November 2025, the rule applies to traders who place four or more "day trades" within five rolling business days that collectively represent more than 6% of their total trades during that time. Pattern day traders must maintain an account balance above $25,000; failure to do so may add restrictions to the account, such as limiting the trader to closing existing positions only. Note that these guidelines are subject to change in the future.

For administrative purposes, opening and closing a 0DTE options contract on the same day counts as a day trade. However, buying or selling a 0DTE option that expires worthless does not count as a day trade. To avoid any issues, it's important for traders who frequently engage in day trading to monitor their activity and account balance.

Bottom line

0DTE options are a unique, high-risk, and rapidly growing segment of the options market, due to their potential for rapid gains. But they also come with significant drawbacks and the potential for substantial losses. They are therefore not a good fit for beginner traders who are not well-versed in the intricacies of derivatives trading. As with any investment, it's crucial for traders to understand thoroughly the mechanics and risks involved before engaging in 0DTE trading, and to approach them with a well-considered strategy and a clear awareness of the risks.