Trading the VIX: Strategies for the Fear Index

Volatility is a persistent, yet ever-changing force in the market, and the Cboe Volatility Index® (VIX) is the most popular gauge used to track it. While the index itself isn't directly tradable, there are futures, options, and exchange-traded funds (ETFs) tied to it that offer traders a way of expressing their outlook on volatility and market sentiment.

Some traders use VIX investment products as a hedge for their equity portfolios when risks mount. Others prefer to use them independently to speculate on whether volatility will rise or fall. However, trading VIX futures, options, and ETFs is complex and comes with significant risks. Traders need to understand the VIX and the unique characteristics of its investment products before attempting these strategies.

What is the VIX?

Introduced in 1993, the VIX is one of the most popular measures of the market's expectations for volatility in the S&P 500® index (SPX).

The VIX price is calculated using a weighted average of the implied volatilities of Cboe-traded standard SPX options and weekly SPX options, which expire on the third Friday of each month and all other Fridays, respectively. This provides a 30-day forward-looking projection of the S&P 500's implied volatility. Implied volatility—which measures how much an underlying asset's price is expected to change based on options prices—is often viewed as a barometer of trader sentiment. As a result, the VIX is often called the market's "fear gauge."

Higher values for the VIX indicate more implied volatility is being priced into the S&P 500, while lower values suggest less implied volatility is being priced in.

Understanding the properties of the VIX is critical for those looking to trade investment products tied to it. The most important feature of the index is that it typically has an inverse relationship with the S&P 500, meaning when the S&P 500 rises, the VIX falls—and vice versa.

The VIX also tends to be mean-reverting. Unlike equity indexes that can remain above or below their mean price indefinitely, the VIX generally moves back toward its historical average over time.

The thinkorswim® chart below shows the VIX's typical inverse relationship with SPX, and its tendency toward mean reversion.

Source: thinkorswim platform

As previously mentioned, the VIX is not directly tradeable, but the Cboe lists tradeable VIX options and futures contracts. There are also tradable exchange-traded funds (ETFs) that track VIX futures and exchange-traded notes (ETNs), which are debt instruments secured by financial institutions that promise to pay returns based on the performance of VIX futures. However, it's important to note that these returns and the value of the debt instruments are not guaranteed, and investors could lose their entire investment.

Understanding VIX options

Before trading VIX options, it's important to understand their unique traits and how they are priced.

First, VIX options are cash-settled and trade in the European-style, meaning exercise can only occur at expiration. Second, VIX options are available with both monthly and weekly expirations, and they typically expire on Wednesdays.

Third, and perhaps most importantly, the price of a VIX option is determined by the value of the corresponding VIX futures contract, rather than the current spot VIX price.

This means traders need to consider whether the VIX futures curve is in contango or backwardation. Contango is when the futures price is higher than the current spot price, while backwardation is when the futures price is lower than the current spot price.

Want to learn more about contango and backwardation? Check out Schwab's Trader's Talk video on these concepts.

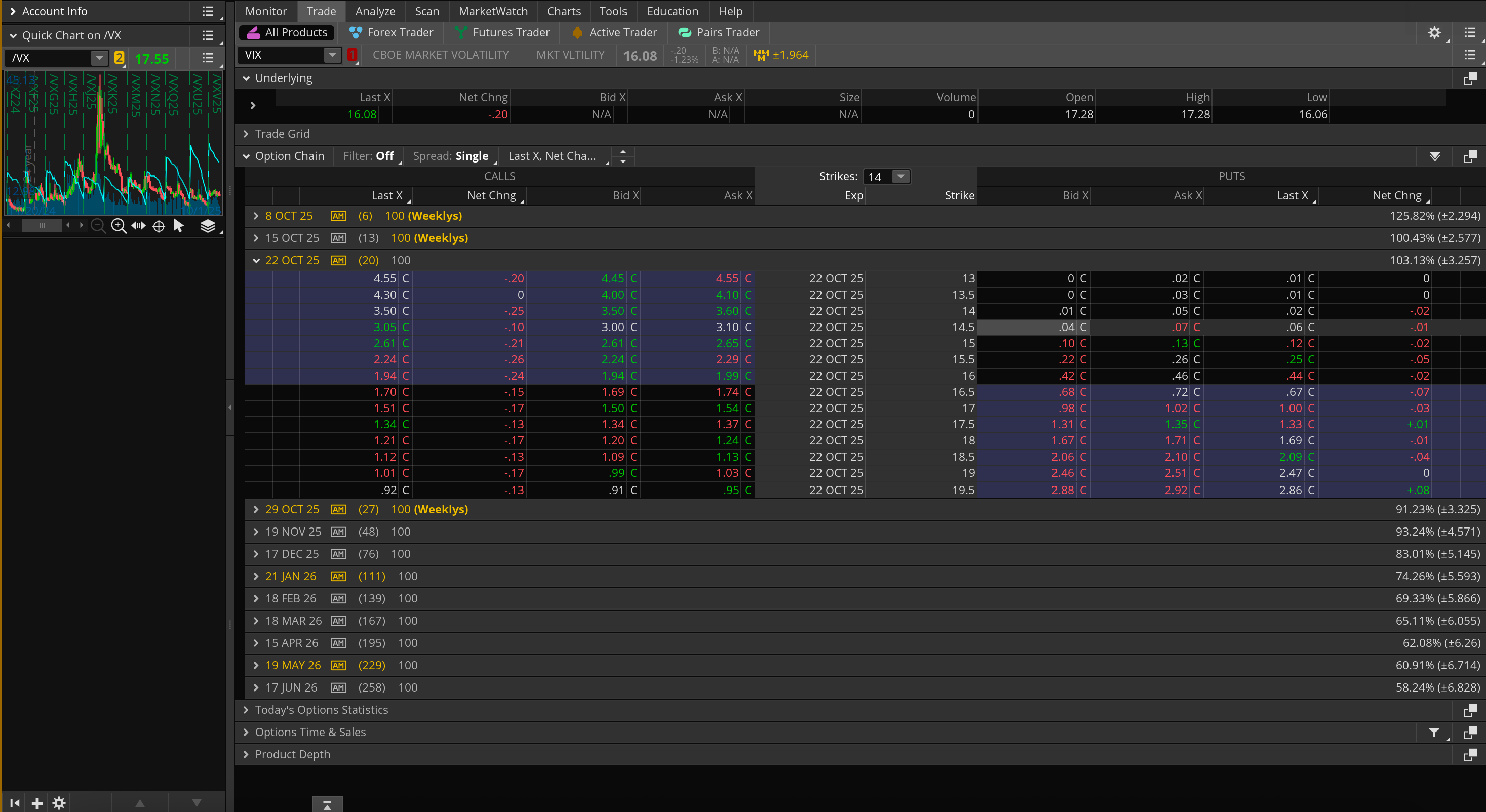

To explain why this is important for traders, let's look at an example where the VIX futures curve is in contango. In the thinkorswim chart below, the spot VIX is trading at $16.08 while the /VX futures price is at $17.53.

In this example, a trader who buys a VIX call at the 16 strike might incorrectly assume their option is at the money (ATM) when, in reality, it's in the money (ITM), and the VIX option nearest to the futures price (the 17.5 strike) is ATM. In this situation, the 16-strike call may be more expensive than anticipated, but it includes some intrinsic value.

Source: thinkorswim platform

However, it's important for option traders to understand that when the VIX futures curve is in contango, the futures price tends to drift down toward the spot price as expiration nears. This process is called convergence, and it acts as a drag on long VIX call values. When compounded with time decay, or theta, eroding the value of these options, it becomes harder to profit from long VIX calls unless the futures price rises substantially.

Conversely, in backwardation, convergence means the VIX futures price typically drifts up toward the spot price as expiration nears. This upward movement tends to support long call values even if volatility doesn't spike further.

Essentially, contango tends to work against long VIX call options, while backwardation typically benefits long VIX call options. This is critical for traders to understand before they begin to use long VIX calls as a portfolio hedge.

And ultimately, whether in contango or backwardation, the VIX futures curve impacts the pricing and payoff of all VIX options. Traders need to be aware of these impacts to trade these options effectively.

Using VIX options as a hedge

Traders often buy VIX calls to hedge against unexpected stock market declines. Depending on what securities the portfolio holds, by purchasing a VIX call, traders can potentially profit from sudden jumps in volatility that often accompany significant stock market declines. It's important to remember, though, that traders may lose 100% of funds invested with long options.

Seasoned option traders might incorporate more advanced VIX options strategies to hedge their portfolios as well, like bull call spreads or call backspreads. These defined-risk trades may be opened for a relatively low cost, allowing traders to potentially add a hedge to their portfolios or gain long volatility exposure.

However, the costs of consistently buying VIX calls or implementing more advanced VIX options strategies can add up, acting as a drag on traders' overall returns. This is called the cost of carry, and it leads many traders to use these strategies more tactically ahead of major events like Fed meetings, elections, or earnings seasons.

As with any trade, VIX trading strategies come with several other significant risks. VIX options trades should only be executed by traders who understand these risks and the potential for profit and loss involved. Consider the following non-exhaustive list of associated risks:

- An imperfect inverse relationship. While the VIX and SPX typically have an inverse relationship, not every stock market sell-off leads to a proportional rise in the VIX. The VIX can remain low even when the stock market is falling, particularly during slow-grinding bear markets. This environment can reduce the effectiveness of VIX hedging strategies.

- Liquidity risk. Most VIX options tend to be liquid, but far out-of-the-money (OTM) strikes can have wide bid/ask spreads. VIX spreads also widen during market sell-offs. Wider spreads can cause traders to buy options at inflated prices, sell options at depressed prices, or make rolling or unwinding positions slow and costly.

- Timing risk. Timing is key with VIX hedging strategies because spikes in the VIX are often short-lived. If traders' options expire before or after a volatility event, the hedge can prove ineffective.

- Valley of death. Traders may see their OTM VIX call options fall into the so-called "valley of death," where volatility increases are too small to generate a profit from the hedge. This can cause the position to lose money over time as the value of the option erodes due to time decay. VIX hedges often rely on a quick spike in the index.

A VIX hedge example

Let's walk through an example of how VIX call options can be used to hedge an equity portfolio. Imagine a scenario where the S&P 500 is trading at or near record highs, and VIX futures are trading at a relatively low level around $15.

In this case, a trader could use a bull call spread to potentially profit from a rise in the VIX, effectively hedging against declines in an equity portfolio with a defined-risk trade that can typically be placed for a small net debit.

To execute this trade, the trader would:

- Buy an ATM VIX 15-strike call expiring in 30 days

- Sell an OTM VIX 20-strike call expiring in 30 days

In this example, let's imagine the trade could be placed for a net debit of $0.50. The maximum loss would then be the net debit paid ($0.50), while the maximum gain would be $4.50 per spread, or the difference between the short call and long call ($5.00) minus the net debit paid ($0.50).

If the VIX rose to $18 before the options expired, the short call's value would fall, while the long call's value would increase. Any profit from closing out this trade at this point could offset losses in other areas of the trader's portfolio.

Note: Transaction fees—and the role of contango or backwardation of the VIX futures curve—are not considered in this example.

While a bull call spread strategy could also potentially hedge against a market crash like those typically seen during Black Swan events, from COVID-19 to the Global Financial Crisis of 2008, it's not specifically designed to do so. The strategy also generally involves additional costs and does not assure a profit or guarantee against a loss. To attempt to profit from dramatic spikes in volatility that often come with rare, unexpected events, some advanced traders choose to place more speculative trades.

Using VIX options to speculate

Buying far OTM VIX call options is one way traders may attempt to speculate on rapid increases in volatility that often take place during Black Swan events.

Far OTM VIX call options can be inexpensive, and if volatility rises dramatically, they can potentially provide sizeable profits. However, this strategy relies on a large and rapid jump in volatility, which is unlikely, making it a risky, speculative trade. As a result, many traders refer to these far OTM options as "VIX lottery tickets" or a form of "doomsday hedge."

Traders can also buy VIX put options to speculate on decreasing volatility or a return to a bullish market after a period of market turmoil. The goal is to take advantage of the VIX's tendency to mean-revert over time. Profiting from these put options requires successfully timing the market's twists and turns, making it another risky, speculative endeavor.

More advanced traders may also opt to use VIX options spreads—like verticals or ratio spreads—in an attempt to improve the profit potential of speculative VIX trades while managing premium costs. Some even pair VIX options positions with equity ETF options in cross-asset volatility arbitrage strategies aimed at potentially profiting from the differences between implied and realized volatility.

Traders should keep in mind the many risks involved with using advanced VIX options strategies to speculate, however. VIX options speculation may increase the previously discussed risks that come from illiquidity, timing errors, the cost of carrying VIX options, the imperfect inverse correlation between the VIX and SPX, and more.

A word on VIX futures and ETFs

Similar to buying VIX call options, buying VIX futures (or ETFs tied to these futures) may help traders hedge equity portfolios or take advantage of the historically inverse correlation between the VIX and SPX.

However, trading VIX futures directly requires a margin account and comes with significant risk. Some retail traders will gain exposure to VIX futures through ETFs and ETNs instead.

Unlike equity ETFs, these products aren't designed to be long-term holdings, particularly because they can lose value over time when the VIX futures curve is in contango. Instead, the goal of VIX ETFs and ETNs, much like VIX options and VIX futures, is to gain short-term exposure to market volatility. These funds can act as a hedge against potential stock market declines or help traders speculate on shifts in volatility, but like VIX options, they tend to profit only from sharp, short-term moves in VIX futures.

Bottom line

Traders are understandably fascinated by the VIX. Its tendency to spike during periods of economic and market turmoil can be alluring to those looking to protect their equity portfolios. Products tied to the index can also allow traders to directly express their views on, and potentially profit from, rapid swings in market volatility.

However, trading VIX options, futures, and ETFs can be complex and comes with significant risk of loss, which can exceed the initial amount deposited. Traders should ensure they understand these products and the VIX itself before entering any trade.