Looking to the Futures

Gold Wins the Gold for 2026

Following a spectacular year for precious metals, the start of 2026 has been marked by significant volatility. In 2025, silver (/SI, +141%) and platinum (/PL +125%) more than doubled, while palladium (/PA, +82%) and gold (/GC, +64%) brought up the rear. Since the start of the year, they have all seen significant volatility, with gold (5626.80), silver (121.785) and platinum (2925) reaching all-time highs in January before a big correction came for all of the precious metals at the end of the month. In that context, gold has held up the best so far this year. Gold is 12% down from its all-time high, while platinum has dropped 29% and silver retreated by 38%. Palladium is 20% below its recent high of 2195.50, while its peak of 3425 was reached in 2022. Year-to-date, gold is up over 14%, while the others are up 6% or less.

Part of the reason for gold’s outperformance this year could be due to its relative underperformance from last year through the January highs. A big part of the performance of the other metals was structural deficits. There are inelastic industrial sources of demand for silver, platinum and palladium.

For platinum, demand exceeded supply by approximately 692,000 ounces, the third consecutive year with a market deficit. Palladium also showed a deficit for 2025 of around 300,000 ounces. Both platinum and palladium are platinum-group metals which often come from the same types of deposits and are mined as byproducts from copper and nickel mines. Their prices are highly correlated with each other since they are both used as catalysts for chemical reactions, and in many cases, users can swap the metal that is more expensive at the time for the cheaper one.

Silver also saw another year of supply deficits in 2025. Demand exceeded supply by 95 million ounces. It was the fifth consecutive year of deficits. Silver supply remained flat for the year, with mine production flat and recycling posting a 1% increase. Similar to platinum and palladium, a large part of silver demand comes from industry, where there is less price sensitivity. Over the longer term, however, industrial consumers of silver may pivot to other resources if prices remain elevated relative to prior years. Solar panels are a significant source of demand, and producers could switch to technologies that use cadmium and tellurium.

Another part of gold’s divergence from the other metals is central bank purchases. Central banks hold gold to hedge inflation and diversify holdings, along with avoiding counterparty risk. Central banks have the ability to “buy the dip and sell the rip” which can reduce short-term volatility in prices. Central bank purchases totaled a net of 863 tons last year, with much of the buying front-loaded in the year, avoiding buying during the runup during the second half of the year.

Technicals

The 6-month daily chart shows the rally that started in August before breaking down at the end of January. The price action since then has pushed the 9-day SMA below the 20-day, but the stabilization since then has pushed the 9-day to within 25 points of the 20-day. The crash also moved the MACD into negative territory. However, it took the RSI from highly overbought levels to around neutral. The Hightower Report has today’s support at 4789.4 and 4711.7, with resistance at 5009.5 and 5152.1.

9-Day SMA 4992.70

20-Day SMA 5016.90

50-Day SMA 4725.4

14-Day RSI 52.1

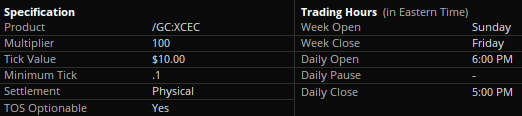

Specifications

Economic Calendar

Building Permits 8:30 AM ET

Capacity Utilization 9:15 AM ET

Durable Orders 8:30 AM ET

Durable Orders -ex transportation 8:30 AM ET

FOMC Minutes 2:00 PM ET

Housing Starts 8:30 AM ET

Industrial Production 9:15 AM ET

MBA Mortgage Applications Index 7:00 AM ET

Net Long-Term TIC Flows 4:00 PM ET

New Products

New futures products are available to trade with a futures-approved account on all thinkorswim platforms:

- Ripple (/XRP)

- Micro Ripple (/MXP)

- Micro Corn (/MZC)

- Micro Wheat (/MZW)

- Micro Soybean (/MZS)

- Micro Soybean Oil Futures (/MZL)

- Micro Soybean Meal Futures (/MZM)

- 1 OZ Gold (/1OZ)

- Solana (/SOL)

- Micro Solana (/MSL)

Visit the Schwab.com Futures Markets page to explore the wide variety of futures contracts available for trading through Charles Schwab Futures and Forex LLC.