Are Tariffs Over? Court Ruling Isn't the End

Tariff policy took yet another turn this week after a U.S. trade court blocked much of President Donald Trump's tariff regime, followed by a legal battle that may take weeks and keeps the currently announced "emergency" tariffs in place for now. The tariffs in question include the across-the-board 10% tariff on all imports, higher tariffs on imports from Canada, China and Mexico, and the "reciprocal" tariffs—a fluctuating range of levies on dozens of countries that Trump announced in early April before pausing them for 90 days. Here's what has happened and what it may mean for investors.

Trade uncertainty may now be controlled by the courts

The Trump administration quickly filed an appeal to the U.S. Court of Appeals for the Federal Circuit, which put a temporary stay on the ruling while the appeals process proceeds. The case could eventually go to the Supreme Court.

If reciprocal tariffs are not enacted using the emergency authority of the International Emergency Economic Powers Act (IEEPA), the Trump administration is likely to come up with other means to increase tariffs, although they may be less arbitrary, limited in size and scope, or may take time to implement.

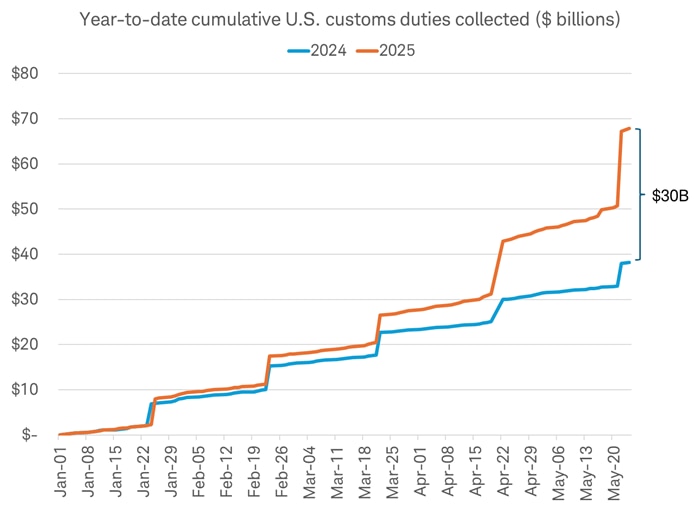

Year-to-date tariffs paid have been higher this year than in 2024

資料來源:嘉信理財、美國財政部、彭博數據,截至 2025 年 5 月 29 日。

What to watch now

- What happened: On May 28th, the U.S. Court of International Trade (CIT) ruled to block the tariffs imposed under the International Emergency Economic Powers Act (IEEPA). On May 29th, after the Trump administration appealed, the U.S. Court of Appeals for the Federal Circuit granted an administrative stay, temporarily blocking the CIT ruling and keeping the tariffs in place until it rules on the administration's motion for a longer-term pause.

- What's at stake: The use of IEEPA to impose "reciprocal tariffs" (including the 10% baseline), as well as the border/fentanyl emergency tariffs on imports from Canada, Mexico, and China.

- What's next: The Federal Circuit laid out a briefing schedule wherein the plaintiffs in the case filed at the CIT have until June 5th to respond and the Trump administration has until June 9th to respond. However, this is merely the first step in the litigation process, which could take several weeks.

- What's still on: Sector-specific tariffs on steel, aluminum, autos, and auto parts, which were instituted under Section 232 of the Trade Expansion Act of 1962.

- If the CIT ruling survives appeal, what would a timeline for new tariffs look like? In a couple of weeks, the Trump administration could use Section 122 of the Trade Act of 1974 to place 10%-15% universal tariffs, but for no more than 150 days while the Office of the U.S. Trade Representative undertakes more lengthy processes. It may expand the use of Section 232 national security investigations to cover products from many different sectors. Investigations typically take nine to 12 months, but several are already underway and others could be accelerated. Since Section 301 of the Trade Act of 1974 has already been in place since the first Trump administration on Chinese imports, this may be able to be used quite quickly.

Bottom line

Trump's tariffs remain in place for now but a legal battle lies ahead. Trade negotiations likely will become more difficult and there may be less urgency for countries to cut deals now, particularly for those with less exposure to targeted sectors. There may be some relief that tariffs may be less arbitrary and reduced in severity or duration, but the next steps are complicated and likely to extend uncertainty for businesses and the economic outlook. The nature of tariffs may change but they are still a risk to economic growth. Investors may be becoming desensitized to tariff news, but economic uncertainty and market volatility could continue.