Diversification: Finally Back After 20 Years

Key Points

The trend in the degree to which the world's stock markets move in sync with each other has fallen to the lowest level in 20 years.

The lower correlation enhances the potential risk-reducing benefits of diversification.

This may be especially good news right now since stocks may be due for a pullback.

Stocks are off to a strong start this year, but the bulls aren't running in a herd. Bull markets can be found in the stocks of countries around the world, but their movements are less correlated with each other than they have been in the past 20 years. The change brings the return of an important diversification benefit for holders of globally diversified portfolios.

Zigs and Zags

Traditionally, the logic behind including international stocks in a portfolio was not just for their potential returns, but also for the benefit of risk-reducing diversification. The thinking is that when one market would zig, another would zag, resulting in a smoother path to financial goals.

Sadly, for much of the 2000s, global diversification had all but faded away as stocks around the world increasingly moved in sync with each other. In our view, there were a couple of key reasons for this.

- Global stocks were collectively impacted by the U.S.-focused technology and housing bubbles.

- The increasingly integrated global economy boosted international sales to exceed domestic sales for the global companies in the MSCI All Country World Index.

- These factors contributed to higher correlations across stock markets: when one market would zig, the others would zig too.

Return to normal?

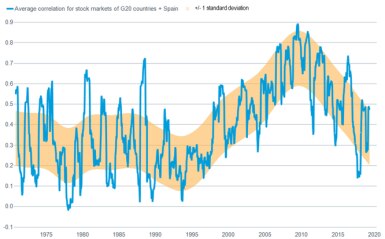

Fortunately for investors, diversification has made a comeback. Measured statistically, the trend in correlation between stock markets of the Group of 20 nations (plus Spain, which is a quasi-member), that together make up 80% of world GDP, peaked in 2011 and has since fallen to levels not seen in 20 years, as you can see in the chart below.

Trend in global stock market correlation slides to 20 year lows

This decline in correlation has taken place despite broad economic growth in these economies and in the trade among them. On the chart above, it almost appears to be a return to "normal" for correlation as the trend illustrated by the standard deviation has moved back to the average level that prevailed for more than 25 years through the 1970s, 1980s, and for much of the 1990s prior to the bubbles in tech and housing.

Potential pullback

If sustained, this lower correlation—and the risk-reducing benefits of diversification it suggests as markets move more independently of each other—is particularly good news right now. Stocks may be due for a pullback given recent warning signs such as inversion of the yield curve.

Will the decline in correlation to a 20 year low persist or might global stock markets all slide together? We only have to look back to last year for some evidence that correlations may remain relatively low. Stock markets around the world suffered varying degrees of losses last year, including a sharp bear market decline late in the year. Yet, correlations rose only to the top of the downward-sloping range, rather than all the way back to prior highs of 2011. This offers some confidence that even during bear markets correlations may remain lower than in the 2000s.

The driver of lower correlations among countries seems to be lower correlations among sectors that drive the stock markets of different countries. For example, energy stocks have had a wild ride in recent years, while tech stocks have been relatively steadily climbers. Financial stocks have been volatile and tied to the movements in the yield curve. As long as these divergent drivers keep sector correlations from rising, country correlations should also remain relatively low.

Main risk

In our view, the main risk to the trend of lower correlations is a global event that causes all sectors and countries' stock markets to move down together. The global economic, financial and market system now seems better prepared to manage the shocks of the past—such as the 2000-02 "Tech Wreck" and the 2008-09 global financial crisis—were they to repeat in the future. But there are other increased vulnerabilities that could cause a shock to turn into another crisis and result in a return to high correlations, including:

- High debt levels

- Political fragmentation

- Dependence on international sales

- Little fiscal or monetary policy ammunition

- The rise of passive investments

For insights on all of these see our recent article: Where Will The Next Crisis Come From?. While plausible, these vulnerabilities developing into a crisis are not part of our base case, at least for the coming year or two.

Big benefit

The return to the lower average correlation across stock markets not seen in 20 years has the potential to offer globally diversified investors the benefit of less volatility without hampering returns on the path to financial goals—in essence decreasing risk without decreasing return.