Schwab Market Update

Stocks Steady, Oil Down After U.S. Attack on Iran

Published as of: June 23, 2025, 9:04 a.m. ET

Listen to this article

Listen here or subscribe for free to the Schwab Market Update in your favorite podcast app.

| The markets | Last price | Change | % change |

|---|---|---|---|

| S&P 500® index |

5,980.87 |

-1.85 |

-0.03% |

| Dow Jones Industrial Average® |

42,171.66 |

-44.14 |

-0.10% |

| Nasdaq Composite® |

19,546.27 |

+25.18 |

+0.13% |

| 10-year Treasury yield |

4.42% |

+0.03 |

-- |

| U.S. Dollar Index |

98.71 |

-0.20 |

-0.20% |

| Cboe Volatility Index® |

19.38 |

-2.79 |

-12.54% |

| WTI Crude Oil |

$75.11 |

-$0.03 |

-0.04% |

| Bitcoin |

$106,170 |

+$2,205 |

+2.17% |

(Monday market open) A long cold war between the U.S. and Iran turned hot over the weekend and Wall Street reacted with a collective shrug. Crude oil (/CL) surrendered overnight gains and stocks recovered most of their earlier losses as the opening bell neared. While the market didn't seem overly fazed, the U.S. dollar and Treasuries gained, sometimes a sign of investors embracing perceived safety. Volatility also ticked up. Crude might ultimately tell today's tale. It's subdued for now but up around 20% over the last month.

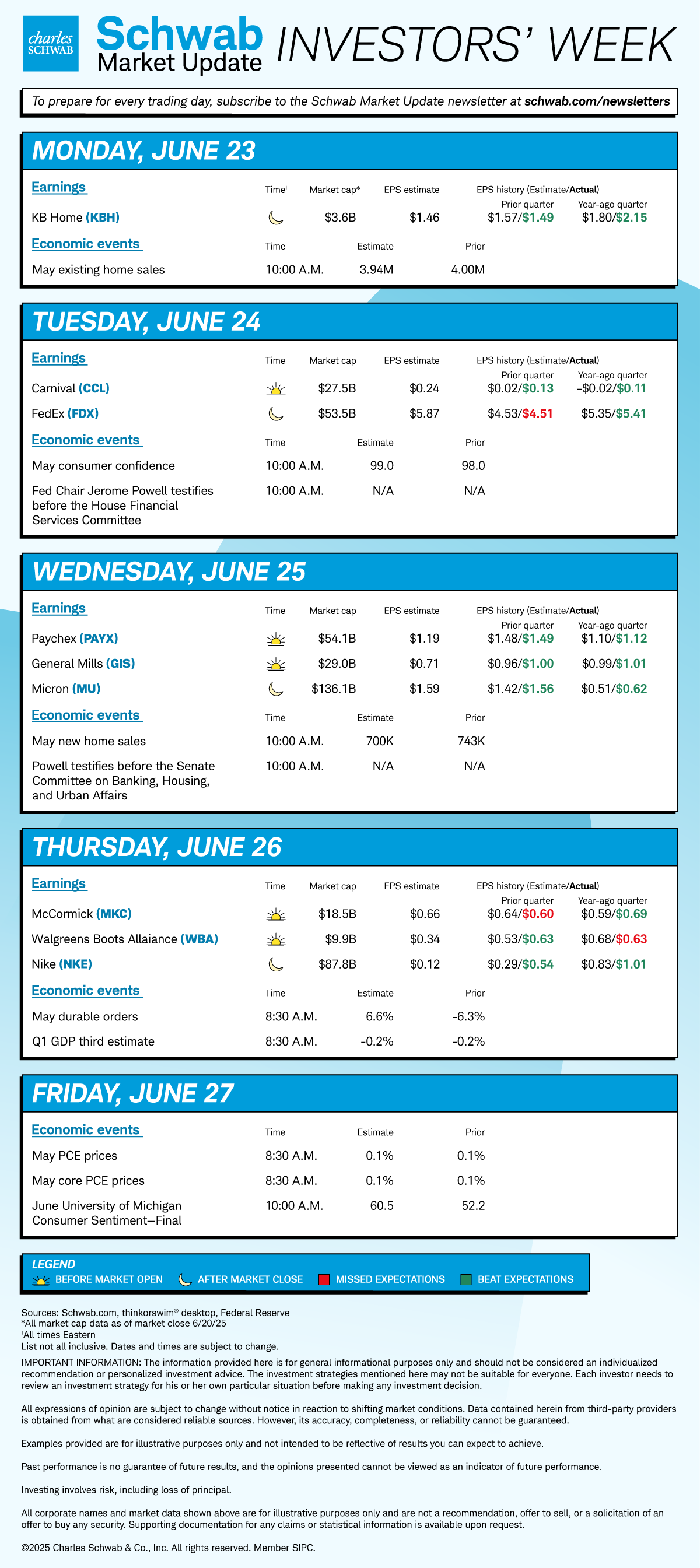

Even without Middle East worries, Wall Street faces a possibly volatile week. Federal Reserve Chairman Jerome Powell is back in the spotlight tomorrow and Wednesday testifying to Congress. Friday features May Personal Consumption Expenditures (PCE) prices, the inflation data most closely followed by the Fed. Also, earnings pick up with KB Home (KBH), Nike (NKE), Micron (MU), and FedEx (FDX) on tap. It starts with KB Home later today, while commentary from FedEx could be scrutinized for potential insights on business and consumer sentiment.

The S&P 500 index just fell three straight days and lost ground overall last week as investors digested a Fed that didn't promise rate trims anytime soon. Many Fed speakers loom today and this week. Market momentum seems to be fading, judging from a decline in the relative strength index (RSI) and declining breadth. And 30- and 90-day hedging activity recently picked up, a sign that investors might see turbulence ahead. "Recent bullish momentum has transitioned into sideways consolidation," said Nathan Peterson, director of derivatives analysis at the Schwab Center for Financial Research.

To get the Schwab Market Update in your inbox every morning, subscribe on Schwab.com.

Three things to watch

- Deadlines mount as month winds down: Though major indexes remain just a few percentage points away from all-time highs, there's a sense of wait and see on Wall Street thanks to major deadlines hanging overhead. President Trump gave Congress until July 4 to settle on a budget bill, but the Senate and House measures have differences that need sorting out. The July 9 tariff deadline is approaching quickly with little sign of progress. A third deadline—the two weeks Trump promised to delay action on Iran—became obsolete with Saturday's U.S. attack on Iran's nuclear sites, so that's one less countdown. Markets don't like uncertainty, and the situation in Iran and its impact on oil casts a wide shadow. The Cboe Volatility Index (VIX), a popular gauge of market fear, climbed to nearly 22 early Monday, well above recent lows below 18 and above its historic average of 20. A rising VIX often hints of stock market struggles ahead.

- Fed may face gasoline-driven inflation threat: Gas prices climbed $0.06 nationwide since the Middle East war began according to AAA, possibly posing new trouble for the Fed. And that was before U.S. involvement began. Though the Fed tends to look past oil and its historic volatility, a sharp ascent above $140 a barrel in 2022 after Russia attacked Ukraine helped spark global inflation that year, and the Fed got criticized for its slow response. It's not necessarily the price of oil itself that hurts the economy, but how fast it rises. Most transport companies like trucking firms and airlines hedge gasoline to avoid surprise blows to their margins, but consumers can't fill up months ahead of time at today's price. When U.S. prices hit $5 a gallon in 2022, consumer sentiment dove and stocks slumped. If people pay more to fill up, they often spend less on other things. That’s troubling for consumer discretionary stocks considering back-to-school and holiday shopping seasons already face the threat of tariff-driven inflation.

- Oil market not yet in dire "straits": While there's concern Iran might close the Strait of Hormuz and block oil exports out of the Persian Gulf, doing so would harm Iran itself. Oil sales to China are about 6% of Iran's economy and equal to about half of Tehran's government spending, The New York Times reported. A vote by Iran's parliament Sunday to close the strait doesn't mean it will happen, as the decision is made by the country's supreme leader, Ayatollah Ali Khamenei. Separately, The Wall Street Journal points out that any hindrance in Iranian oil exports might hurt China's economy. Some economists say if Iran did shut down the strait, oil futures (/CL) could soar to $120 a barrel from below $80 now. However, military strategists said it might be difficult for Iran to keep the strait closed, and that Iran may consider other responses to the U.S. attacks. Another factor making an oil spike less likely: spare capacity. A lot of it. The world has more than four million barrels a day it could be producing but is not, Reuters reported.

On the move

- Tesla (TSLA) climbed half a percent in pre-market trading after the company introduced its driverless taxi service in Austin yesterday. Initial rides were limited to a small portion of town, Bloomberg reported, carrying investors and social media influencers.

- Bitcoin (/BTC) fell nearly 2% approaching Wall Street's open but is up from overnight lows. The cryptocurrency appears sensitive to possible risk aversion in the wake of the U.S. attack, and initially fell below $100,000. It's now back to $101,000 but well below recent record highs above $110,000.

- Kroger (KR) slipped early today after a more than 9% rise Friday following a strong earnings report from the grocery firm. Kroger reaffirmed guidance for fiscal 2026 and raised its full-year guidance for non-fuel comparable sales, meaning sales at stores open a year or more, to a range of 2.25% to 3.25% from prior 2% to 3% guidance.

- Circle Internet Group (CRCL) climbed 6% early Monday after another big day Friday in which Coinbase (COIN) added 3% and Circle climbed nearly 23%. Last week, the U.S. Senate passed a key stablecoin bill, known as the GENIUS Act, by a vote of 68-30 with bipartisan support. COIN shares fell this morning along with Strategy (MSTR) as the crypto market watched developments in the Middle East.

- AppLovin (APP) slipped another 0.5% today after falling more than 5% Friday despite a lack of major news developments related to the stock.

- Shares of energy firms including Exxon Mobil (XOM) and Chevron (CVX) climbed more than 1% amid the Middle East turmoil and rising oil price fears.

- Defense firms Northrop Grumman (NOC) and Lockheed Martin (LMT) each rose 0.5% as war raged in the Middle East.

- Super Micro Computer (SMCI) fell 4.6% in pre-market trading on news the company plans a $2 billion convertible senior note offering.

- Exelixis (EXEL) jumped nearly 22% ahead of the open on positive results from a phase 3 cancer drug trial.

- Him & Hers Health (HIMS) dropped 16% in pre-market trading on a Reuters report that Novo Nordisk (NVO) wants to end its weight loss drug collaboration with the company. Novo shares fell 5.5%.

- Northern Trust (NTRS) climbed 5.5% ahead of the open as The Wall Street Journal reported NTRS had been approached by Bank of New York Mellon (BK) to discuss a possible merger.

- Technically, the S&P 500 faces possible resistance around 6,050 to 6,100 and has seen "tentative" recent price action, said Schwab's Peterson. The index touched its 20-day moving average Friday for the first time since late April. Accompanied by a declining RSI, this suggests slowing momentum.

- Checking breadth, as of late Friday, 48.4% of S&P 500 stocks traded above their 200-day moving averages down from 53.8% a week earlier, while 35.2% of Nasdaq stocks traded above their 200-day moving averages, down from 39.1% a week earlier. Breadth is a good way to track market sentiment, with rising breadth often indicating greater participation from more of the market in a rally.

More insights from Schwab

IPO tracking: The sluggish initial public offering market showed signs of life this month, especially for crypto-related IPOs that rallied sharply on their first trading days and in sessions that followed. This could signal improved investor sentiment, but the number of IPOs still lags historic averages.

Chart of the day

Data source: Cboe. Chart source: thinkorswim® platform.

Past performance is no guarantee of future results.

For illustrative purposes only.

Though the benchmark 10-year Treasury note yield (TNX:CGI—candlesticks) fell four basis points in total last week, it remains near the middle of the range it's spent most of its time in over the last two months between roughly 4.3% and 4.5%. The Fed meeting and its rate and economic projections didn't appear to have much impact on rates, nor have recent Treasury auctions. Still, bond market volatility could resurface in coming weeks as investors wrestle with the many key deadlines on tariffs and the U.S. budget. Generally, yields have been moving somewhat lower since mid-May after wider swings in the April and early May timeframe.

The week ahead